The Dallas Stars' Top Line with Wyatt Johnston Was Dominant

Outrageously dominant, but how good can they be?

On January 16, 2024 in the Dallas Stars’ 43rd game of the season, coach Pete DeBoer moved Wyatt Johnston up to the Stars’ top line in place of a struggling Joe Pavelski and the line with Johnson, Jason Robertson, and Roope Hintz promptly went supernova. Johnston remained on the top line, which I’ll refer to as the Johnston line from here on out, for the following eight games and the Stars amassed a 6-2-1 record over their first nine games together. After that, Pavelski returned to the top line, though the Johnston line was reunited for parts of two additional games later, both losses, bringing their total time together to a little under 110 minutes at 5-on-5.1

In total, the Johnston line rolled over opponents at 5-on-5 to the tune of a 70% corsi share, an 83% expected goals share, and a 90% real goals share. With Joe Pavelski retiring this summer, one of the questions for the Stars heading into the new season is where will Johnston play? Will the Johnston line be reunited, will he continue to center Jamie Benn and Logan Stankoven, or will DeBoer try something new? In this article, I look at how the Johnston line performed last season, how it stacks up to other lines historically, and what can be expected from them should DeBoer opt to keep the party going.

Methodology

The numbers in this article for the Johnston line and other lines differ from what is listed on Evolving-Hockey, Natural Stat Trick, or elsewhere because I used a more restrictive definition of ice time together to calculate a forward trio’s ice time and on-ice statistics. Those sites use all instances of the three players being on the ice together to calculate line totals, including situations such as incomplete line changes or penalty expirations. I wanted to compare lines that were intentionally put together by a coach for a game and played in standard 5-on-5 situations (three forwards and two defensemen per side), so I limited my analysis to those situations. I don’t think this makes much of a difference in the big picture, but I think my process is slightly more representative of each line’s output.

First, to get every line’s shifts, I used the play-by-play data for the 2023-24 season available through Evolving-Hockey to get all the shifts any group of forwards had taken together at 5-on-5. Next, I removed all shifts that did not feature three forwards on each team. This left the forward line combinations for every 3F/2D 5-on-5 shift for the entire season. Next, I removed all shifts for line combinations that did not play at least 200 seconds together.2 Lastly, I removed all line combinations that did not play at least 100 minutes together for their remaining shifts leaving 193 line combinations for the 2023-24 season, including the Johnston line.3

To get shot metrics, I added in all the shot events that occurred during each line’s time on ice, also available from Evolving-Hockey’s play-by-play data, by filling out the seconds played for each shift and joining the shot events by game clock time. I opted to use non-score and venue adjustments for simplicity on my end, but given that eight of their eleven games were on the road and how dominant the line was (most of their time was spent leading), I would only expect adjustments to improve their overall numbers.

Once all this was done for the 2023-24 season, I repeated the process for every season from 2010-11 to 2022-23 to get historic comparables resulting in a total of 2,451 line combinations across fourteen seasons.4

However, the Johnston line played a relatively small amount of time together, which makes comparing different lines difficult. To get around this, I looked instead at rolling 100 minute windows of playing time, looking for each line’s best 100 minutes by both shot differential rate (rate for minus rate against) and shot share (percentage). Then I computed similarity scores for differentials and shot share using Euclidian distance for corsi, expected goals, and actual goals and scaling them from 0 to 1 with 0 being the furthest distance and 1 being a line identical to the Johnston line.

Results

The Johnston Line

First, let’s look at the Johnston line’s performance on its own. I’ve already mentioned their shot shares, but by differential, they put up a +47.8 CF/60 minutes, +3.65 xGF/60, and +4.40 GF/60 overall. Those number ranked first, first, and second respectively for last season among lines with at least 100 minutes, with GF/60 trailing only the Nathan MacKinnon line with Mikko Rantanen and Artturi Lehkonen. Expanding that out to all seasons since 2010, their ranks drop to… first, first, and thirteenth. Historically dominant.

Of course, it’s possible this was the very best the Johnston line was capable of, which makes the comparison to lines with more playing time together misleading. Compared to every other line’s best 100 minutes, the Johnston line ranks seventh (four-way tie), fifth, and 119th (102-way tie. As good as they were, they weren’t ridiculously lucky when it came to goaltending/finishing).

Possibly even more impressive than their raw differential numbers is how they got there.

In addition to the Johnston line’s cumulative differential, I included a trend line in grey for their overall differential rate to demonstrate how consistent the line was in their time together. What’s remarkable is closely they stayed to their overall trend, especially their expected goals differential. By corsi differential, they had only one extended slump, but even then, the quality of chances given up was very low, as is reflected in their expected goals number.

However, the pace of the NHL has trended up over the past decade-and-a-half, meaning the range of shot differentials is wider now than it was 14 years ago. Looking at shot share instead of differential mitigates this issue.

Shot share tells a similarly overwhelming story, though not quite to the same degree. Last season the Johnston line ranked fourth, second (behind the Connor McDavid line with Zack Hyman and Ryan Nugent-Hopkins), and twenty-third (tied) for corsi for percentage, expected goals for percentage, and goals for percentage respectively compared to other line’s best 100 minute segment. Overall since 2010, they ranked thirty-third, fourth (!), and, uh, 407th (35-way tie).5

Looking at cumulative shot share reveals the same consistency shown above in the rate differential chart.

The line was incredibly consistent after about 40 minutes together, with both CF% and xGF% hovering around their overall shares. Now, as I’ll get to in the next section, I would not expect this to continue over the long haul because all players and lines go through slumps, but the underlying numbers support their results.

Furthermore, it is notable that the expected goals share is consistently above the corsi share, and the goals share is pretty consistently above the expected goals share. This means that the Johnston line not only generated more chances than their opponents, but those chances were on average better than the chances they gave up. They also benefitted a bit from goaltending/finishing, though with Robertson especially on the line, some above average finishing should be expected.

Comparables

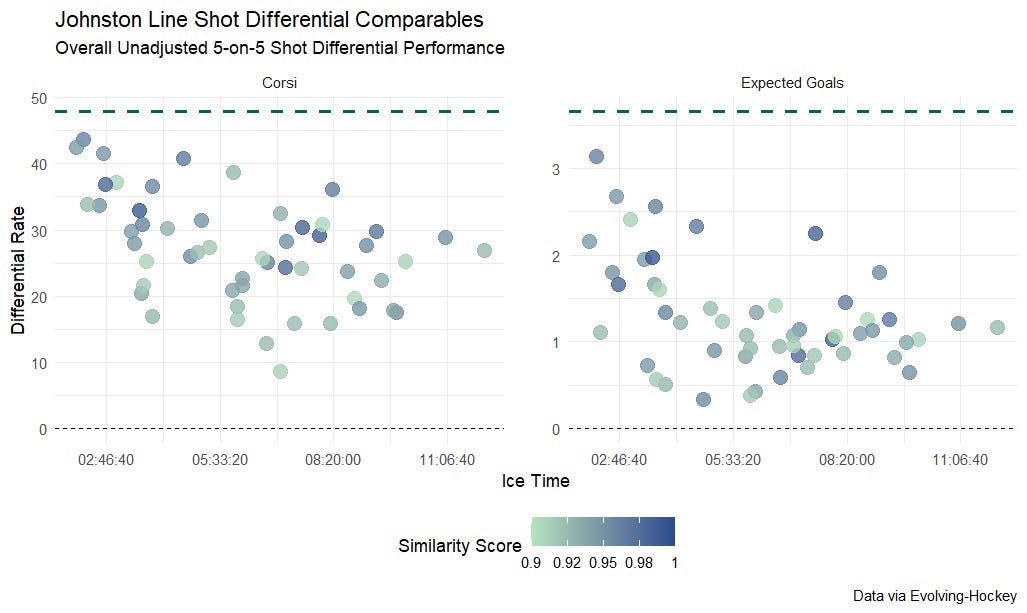

Next I would like to look at comparable performances from past lines. As discussed in the methodology section, I looked at the most similar lines not based on their overall performance, but on their best continuous 100 minute segment. However, to look at what the future range of outcomes could be for the Johnston line, I looked at the overall performance for every line with a similarity score of at least 0.9. This exercise was repeated for both shot differentials and shot shares.

Shot Differentials

53 lines scored above 0.9. The chart below shows their overall corsi and expected goals differential rates, versus their total ice time. The dashed line represents the Johnston line’s overall differential rate.

The first thing that stands out is that all of the comparable lines performed at a lower level than the Johnston line over the long haul. Additionally, within the comparables there is a clear trend towards an even differential as ice time increases. Even so, however, the vast majority of these lines continue performing at an elite level. Only two lines are below an overall corsi differential of +15 per 60 minutes. The majority of lines exceeded +1 expected goal per 60 minutes and only three fell below +0.5. So although some drop out of the stratosphere should be anticipated, unless the Johnston line is the worst to ever perform at such a high level, the Stars should feel comfortable expecting continued elite performance from them.

The table below lists all of the most similar lines, featuring several top lines on Stanley Cup Finalists, either in the same season or the seasons immediately before or after and some of the best lines in recent history (six versions of Patrice Bergeron with Brad Marchand appear on this list).

Shot Shares

Only 25 lines scored at or above 0.9 similarity for shot shares. As before, the dashed line represents the Johnston’s line.

Here we see a similar trend towards a 50% shot share, though not as pronounced with corsi share as expected goal share. Again, none of the comparable lines dropped below 50% and only one dropped below 55% in either metric. A majority were able to maintain a 60% share in at least one metric and often both.

And for completeness, here is a table of all the most similar lines by shot share. Again, it’s a largely impressive list with even the worst performing lines still grading out as well above average.

Conclusion

The Stars’ top line with Wyatt Johnston on it arguably the top line in the league last season. Although they should drop back down to earth a bit as they spend more time playing together, based on how other lines with comparable periods of production have performed, that drop-off should still leave them an elite performing unit. Even if Pete DeBoer chooses to separate them to start next season, he’s got a proven group he can turn to if the situation requires it.6

109 minutes and 4 seconds, or 1:49:04, to be exact.

This is a bit arbitrary, but my thought process was average NHL shifts are somewhere between 40 and 45 seconds long. Taking the lower end of that to be as inclusive as possible, I looked for games where a line played together at least 5 shifts at 5-on-5.

100 minutes to include lines that nearly played as much time together as the Johnston line.

I excluded seasons prior to 2010-11 even though they are available on Evolving-Hockey because data recording quality issues make their expected goals model less reliable for those season.

An astounding 307 lines had a 100 minute stretch with a 100% GF%, but overwhelming they did this while generating fewer goals than the Johnston line did.

He may have a good reason to, Johnston with Jamie Benn and Logan Stankoven was also dominant, though to a lesser degree.

With my NFL experience of how bad coaches tend to be at their jobs, it's likely this experiment worked so well that it will never ever be tried again...

On a more serious note, why do you think it is that lines tend to trend worse once they get more time together? I suppose regression to mean is acceptable as an answer, but if this is a line in the performance bracket you were discussing, in theory composed of three really good players, regression towards 50% shouldn't be expected right?

Perhaps this is my innocence shining through. What is a really good shot%? 55? 60? I don't look over line numbers enough to know the answer to this question. Also, do you have any idea how long lines need to be together for their numbers to begin to stabilise? Surely just 100 minutes falls short, but even if it does are there any numbers that tend to remain consistent even in small samples?